ACCESS THE LATEST RESEARCH AND INSIGHTS

A fast food stock predicted to pop 20%

Cost savings and growth in U.S. fast food sales are helping boost

the brands behind this name…

A fast food stock predicted to pop 20%

Cost savings and growth in U.S. fast food sales are helping boost

the brands behind this name…

Beverage Maker’s Transformation ‘Clear As Water’

Analysts who spent time with this $1.6B bottler were impressed enough to raise the target price aggressively and now see 30% upside…

Beverage Maker’s Transformation ‘Clear As Water’

Analysts who spent time with this $1.6B bottler were impressed enough to raise the target price aggressively and now see 30% upside…

Niche, Small Cap SAAS Firm Turnaround Is Turning Heads

A rebound in oil prices will do wonders for this financial services software maker. Expect 90% upside…

Niche, Small Cap SAAS Firm Turnaround Is Turning Heads

A rebound in oil prices will do wonders for this financial services software maker. Expect 90% upside…

We Are Going Weekly!!!

Capital Ideas Research has been publishing for almost 3 years actively bringing the best ideas from the brightest investment minds. Last year, the economy took a turn but we decided to…

We Are Going Weekly!!!

Capital Ideas Research has been publishing for almost 3 years actively bringing the best ideas from the brightest investment minds. Last year, the economy took a turn but we decided to…

Fiera Capital a ‘Buy’ Amid Higher Growth Prospects

Canaccord Genuity is increasing its price target on investment manager Fiera Capital Corp. (FSZ-T) to $16 from $15 and sticking with its “buy” rating due to…

Fiera Capital a ‘Buy’ Amid Higher Growth Prospects

Canaccord Genuity is increasing its price target on investment manager Fiera Capital Corp. (FSZ-T) to $16 from $15 and sticking with its “buy” rating due to…

Q&A with Convalo CEO Stampp Corbin

Stampp Corbin says he took the CEO job at Convalo Health International Corp. (CXV-V) last fall because he wanted to work in a business that helps people, and makes money. Convalo is a Los Angeles-based, TSX Venture Exchange-listed company that provides detox and outpatient rehabilitation services in the U.S.

Q&A with Convalo CEO Stampp Corbin

Stampp Corbin says he took the CEO job at Convalo Health International Corp. (CXV-V) last fall because he wanted to work in a business that helps people, and makes money. Convalo is a Los Angeles-based, TSX Venture Exchange-listed company that provides detox and outpatient rehabilitation services in the U.S.

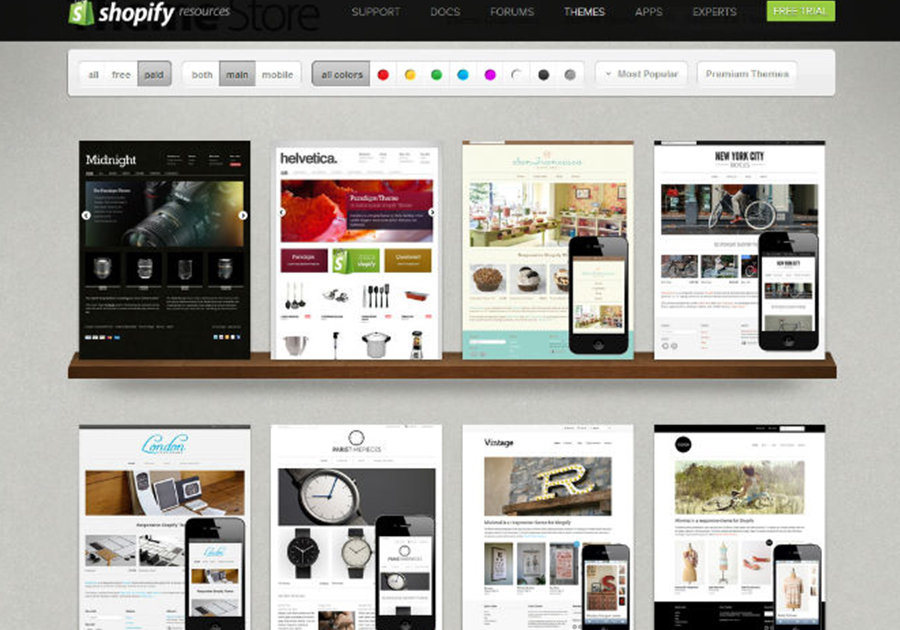

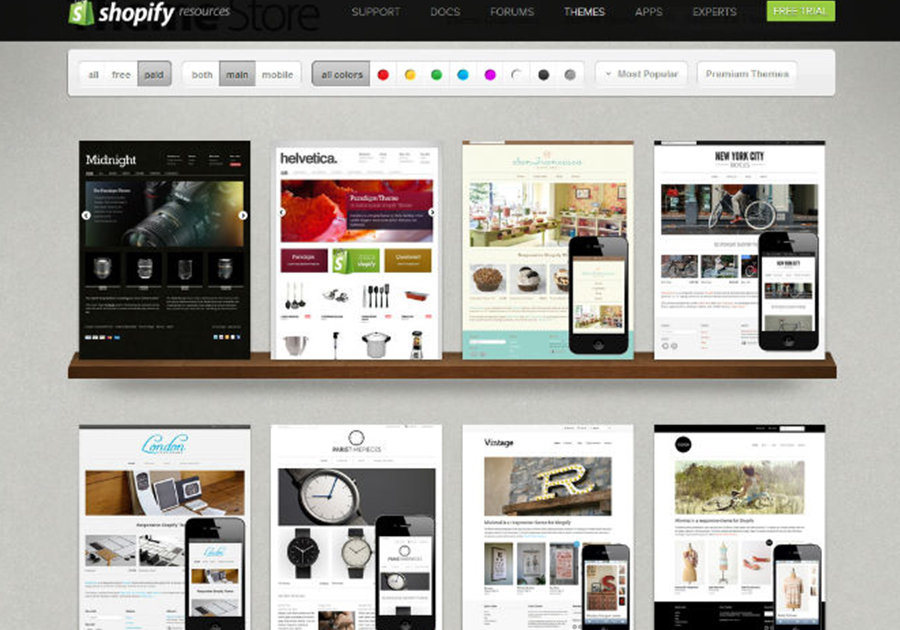

Shopify Upgraded Amid Stronger Software Sentiment

Canaccord Genuity believes the “coast looks reasonably clear” for Shopify Inc. (SHOP-N, SH-T), and upgraded the Ottawa-based tech company to “buy” from “hold” after its latest earnings report.

“We had suggested in the past few research notes that we would consider an upgrade if the company executed and guided well off of this print and we felt that the broader sentiment toward software had stabilized,” analyst Richard Davis in a note on Feb 17. “We believe both triggers were tripped with [Wednesday’s] quarterly print. Therefore, we are upgrading SHOP.”

He described Shopify’s fourth-quarter results as “excellent,” noting it was their third earnings report since the company went public in 2015. Total revenue rose 99 per cent to $70.2-million (U.S.) year over year, and handily beat expectations of $61-million.

Mr. Davis said Shopify’s initial 2016 outlook calls for revenue in the $320 million to $330 million range, which is 58 per cent growth at the mid-point and ahead of consensus at $287 million and his forecast of $290 million.

“Qualitative commentary suggested that GMV [gross merchandise volume] take rates should hold flat to modestly lower and that gross margins on the respective revenue lines are relatively steady, so overall [gross margins] will be affected by mix (i.e. trend down as merchant solutions revenue grows faster).

He noted that operating losses of $16 million to $22 million were worse than his $14 million estimate, “but management remains committed to operating profitability by the end of 2017.”

Mr. Davis did reduce his target price for the stock to $30 (U.S.) from $35, “to take into consideration the

broader valuation re-rating of revenue multiples in the cloud software space.”

The analyst average is $31.25 for the U.S. listed shares. The stock closed at $20.57 on the NYSE on Friday, down 20 per cent year to date. (see chart below)

Shopify was rated new “overweight” at Piper Jaffray by equity analyst Eugene Munster. His 12-month target price is $25 per share.

Shopify Upgraded Amid Stronger Software Sentiment

Canaccord Genuity believes the “coast looks reasonably clear” for Shopify Inc. (SHOP-N, SH-T), and upgraded the Ottawa-based tech company to “buy” from “hold” after its latest earnings report.

“We had suggested in the past few research notes that we would consider an upgrade if the company executed and guided well off of this print and we felt that the broader sentiment toward software had stabilized,” analyst Richard Davis in a note on Feb 17. “We believe both triggers were tripped with [Wednesday’s] quarterly print. Therefore, we are upgrading SHOP.”

He described Shopify’s fourth-quarter results as “excellent,” noting it was their third earnings report since the company went public in 2015. Total revenue rose 99 per cent to $70.2-million (U.S.) year over year, and handily beat expectations of $61-million.

Mr. Davis said Shopify’s initial 2016 outlook calls for revenue in the $320 million to $330 million range, which is 58 per cent growth at the mid-point and ahead of consensus at $287 million and his forecast of $290 million.

“Qualitative commentary suggested that GMV [gross merchandise volume] take rates should hold flat to modestly lower and that gross margins on the respective revenue lines are relatively steady, so overall [gross margins] will be affected by mix (i.e. trend down as merchant solutions revenue grows faster).

He noted that operating losses of $16 million to $22 million were worse than his $14 million estimate, “but management remains committed to operating profitability by the end of 2017.”

Mr. Davis did reduce his target price for the stock to $30 (U.S.) from $35, “to take into consideration the

broader valuation re-rating of revenue multiples in the cloud software space.”

The analyst average is $31.25 for the U.S. listed shares. The stock closed at $20.57 on the NYSE on Friday, down 20 per cent year to date. (see chart below)

Shopify was rated new “overweight” at Piper Jaffray by equity analyst Eugene Munster. His 12-month target price is $25 per share.

TSO3’s ‘Game Changing’ Technology Worth a Look

Canaccord Genuity has initiated coverage of TSO3 Inc. (TOS-T), a company that makes sterilization products for the medical industry, with a “buy” rating and a $3.25 target price.

That is about 70 per cent above its current price around $1.90. The analyst consensus price target for TSO3 over the next year is $3.60. All five analysts that cover the stock have a “buy” rating. The stock is up more than 45 per cent over the past year (see chart below)

“We believe that the stock is an excellent defensive

pick, as the company serves a very steady replacement market,” said analyst Neil Maruoka in a Jan. 27 note. He said hospital sterilization equipment has a finite lifespan, but is a “critical component” of healthcare infrastructure.

“While many incumbents are entrenched, we believe that the capital equipment replacement decision in the current environment hinges largely on cost efficiencies and the mitigation of infection risk – two advantages of TSO3’s product.”

TSO3 develops and manufactures hospital sterilization equipment, with a core product offering called STERIZONE VP4. Mr. Maruoka says the stock has “explosive growth potential.” He projects a four-year top-line organic compound annual growth rate (CAGR) of 90 per cent, and earnings before interest, taxes, depreciation and amortization CAGR of about 60 per cent “as the company transitions to positive cash flow next year.

“The company’s VP4 sterilization system represents a potential game-changing technology, in our view,” he said. “While the sterilization equipment market is mature, capital equipment turnover is approximately 10 per cent or 3,000 units annually and presents a huge opportunity for TSO3.”

He notes the company is backed by partner Getinge, with global marketing clout. “We project that the widening of the VP4 installed base will lead to rapidly growing and recurring consumables revenue and

longer-term margin expansion.”

Market penetration will be key over the next several quarters, as Getinge will need to gain traction in the replacement market to meet our forecasts. We believe that the key factor that could derail the story and our thesis would be slow uptake and high competitive hurdles that could make the Getinge partnership a short relationship.

TSO3’s ‘Game Changing’ Technology Worth a Look

Canaccord Genuity has initiated coverage of TSO3 Inc. (TOS-T), a company that makes sterilization products for the medical industry, with a “buy” rating and a $3.25 target price.

That is about 70 per cent above its current price around $1.90. The analyst consensus price target for TSO3 over the next year is $3.60. All five analysts that cover the stock have a “buy” rating. The stock is up more than 45 per cent over the past year (see chart below)

“We believe that the stock is an excellent defensive

pick, as the company serves a very steady replacement market,” said analyst Neil Maruoka in a Jan. 27 note. He said hospital sterilization equipment has a finite lifespan, but is a “critical component” of healthcare infrastructure.

“While many incumbents are entrenched, we believe that the capital equipment replacement decision in the current environment hinges largely on cost efficiencies and the mitigation of infection risk – two advantages of TSO3’s product.”

TSO3 develops and manufactures hospital sterilization equipment, with a core product offering called STERIZONE VP4. Mr. Maruoka says the stock has “explosive growth potential.” He projects a four-year top-line organic compound annual growth rate (CAGR) of 90 per cent, and earnings before interest, taxes, depreciation and amortization CAGR of about 60 per cent “as the company transitions to positive cash flow next year.

“The company’s VP4 sterilization system represents a potential game-changing technology, in our view,” he said. “While the sterilization equipment market is mature, capital equipment turnover is approximately 10 per cent or 3,000 units annually and presents a huge opportunity for TSO3.”

He notes the company is backed by partner Getinge, with global marketing clout. “We project that the widening of the VP4 installed base will lead to rapidly growing and recurring consumables revenue and

longer-term margin expansion.”

Market penetration will be key over the next several quarters, as Getinge will need to gain traction in the replacement market to meet our forecasts. We believe that the key factor that could derail the story and our thesis would be slow uptake and high competitive hurdles that could make the Getinge partnership a short relationship.