READ THE LATEST CAPITAL IDEAS DIGEST

Beverage Maker’s Transformation ‘Clear As Water’

Analysts who spent time with this $1.6B bottler were impressed enough to raise the target price aggressively and now see 30% upside…

Niche, Small Cap SAAS Firm Turnaround Is Turning Heads

A rebound in oil prices will do wonders for this financial services software maker. Expect 90% upside…

Fiera Capital a ‘Buy’ Amid Higher Growth Prospects

Canaccord Genuity is increasing its price target on investment manager Fiera Capital Corp. (FSZ-T) to $16 from $15 and sticking with its “buy” rating due to…

Q&A with Convalo CEO Stampp Corbin

Stampp Corbin says he took the CEO job at Convalo Health International Corp. (CXV-V) last fall because he wanted to work in a business that helps people, and makes money. Convalo is a Los Angeles-based, TSX Venture Exchange-listed company that provides detox and outpatient rehabilitation services in the U.S.

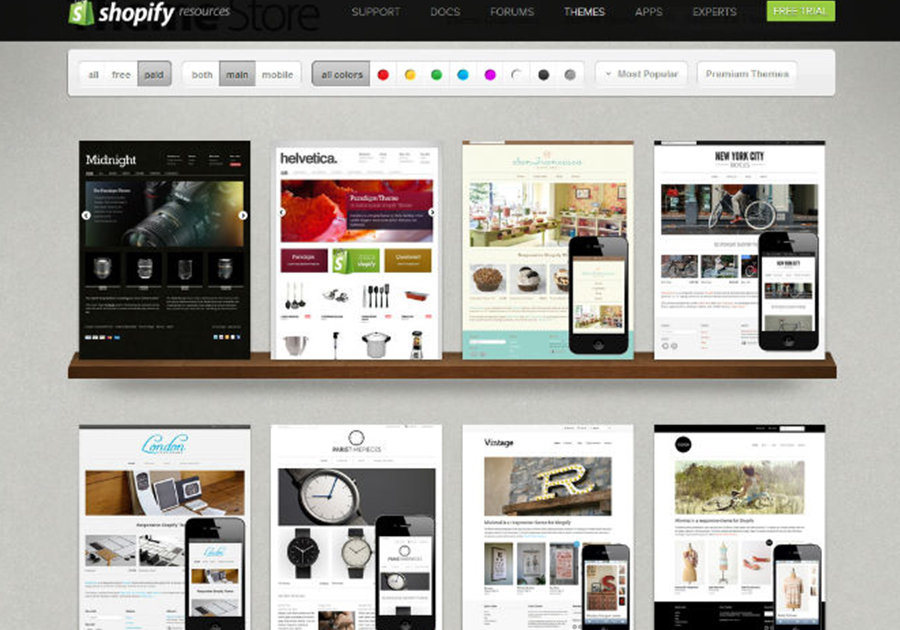

Shopify Upgraded Amid Stronger Software Sentiment

Canaccord Genuity believes the “coast looks reasonably clear” for Shopify Inc. (SHOP-N, SH-T), and upgraded the Ottawa-based tech company to “buy” from “hold” after its latest earnings report.

“We had suggested in the past few research notes that we would consider an upgrade if the company executed and guided well off of this print and we felt that the broader sentiment toward software had stabilized,” analyst Richard Davis in a note on Feb 17. “We believe both triggers were tripped with [Wednesday’s] quarterly print. Therefore, we are upgrading SHOP.”

He described Shopify’s fourth-quarter results as “excellent,” noting it was their third earnings report since the company went public in 2015. Total revenue rose 99 per cent to $70.2-million (U.S.) year over year, and handily beat expectations of $61-million.

Mr. Davis said Shopify’s initial 2016 outlook calls for revenue in the $320 million to $330 million range, which is 58 per cent growth at the mid-point and ahead of consensus at $287 million and his forecast of $290 million.

“Qualitative commentary suggested that GMV [gross merchandise volume] take rates should hold flat to modestly lower and that gross margins on the respective revenue lines are relatively steady, so overall [gross margins] will be affected by mix (i.e. trend down as merchant solutions revenue grows faster).

He noted that operating losses of $16 million to $22 million were worse than his $14 million estimate, “but management remains committed to operating profitability by the end of 2017.”

Mr. Davis did reduce his target price for the stock to $30 (U.S.) from $35, “to take into consideration the

broader valuation re-rating of revenue multiples in the cloud software space.”

The analyst average is $31.25 for the U.S. listed shares. The stock closed at $20.57 on the NYSE on Friday, down 20 per cent year to date. (see chart below)

Shopify was rated new “overweight” at Piper Jaffray by equity analyst Eugene Munster. His 12-month target price is $25 per share.

TSO3’s ‘Game Changing’ Technology Worth a Look

Canaccord Genuity has initiated coverage of TSO3 Inc. (TOS-T), a company that makes sterilization products for the medical industry, with a “buy” rating and a $3.25 target price.

That is about 70 per cent above its current price around $1.90. The analyst consensus price target for TSO3 over the next year is $3.60. All five analysts that cover the stock have a “buy” rating. The stock is up more than 45 per cent over the past year (see chart below)

“We believe that the stock is an excellent defensive

pick, as the company serves a very steady replacement market,” said analyst Neil Maruoka in a Jan. 27 note. He said hospital sterilization equipment has a finite lifespan, but is a “critical component” of healthcare infrastructure.

“While many incumbents are entrenched, we believe that the capital equipment replacement decision in the current environment hinges largely on cost efficiencies and the mitigation of infection risk – two advantages of TSO3’s product.”

TSO3 develops and manufactures hospital sterilization equipment, with a core product offering called STERIZONE VP4. Mr. Maruoka says the stock has “explosive growth potential.” He projects a four-year top-line organic compound annual growth rate (CAGR) of 90 per cent, and earnings before interest, taxes, depreciation and amortization CAGR of about 60 per cent “as the company transitions to positive cash flow next year.

“The company’s VP4 sterilization system represents a potential game-changing technology, in our view,” he said. “While the sterilization equipment market is mature, capital equipment turnover is approximately 10 per cent or 3,000 units annually and presents a huge opportunity for TSO3.”

He notes the company is backed by partner Getinge, with global marketing clout. “We project that the widening of the VP4 installed base will lead to rapidly growing and recurring consumables revenue and

longer-term margin expansion.”

Market penetration will be key over the next several quarters, as Getinge will need to gain traction in the replacement market to meet our forecasts. We believe that the key factor that could derail the story and our thesis would be slow uptake and high competitive hurdles that could make the Getinge partnership a short relationship.

Canadian Assets Managers Facing Tough 2016

Canaccord Genuity has lowered its target multiples on Canadian asset managers, “to reflect market headwinds and lower sales transactions.”

Analyst Scott Chan said the sector’s stocks were down 17 per cent in 2015, compared to a drop of about 8 per cent for the S&P/TSX Composite Index.

So far in 2016, the asset managers he covers are down another 17 per cent on average “as market sentiment within the segment remains weak,” he said in a Jan. 20 note.

“We believe valuations are unlikely to re-rate medium term due to a number of headwinds: (1) market downturn; (2) lower mutual fund flows; (3) margin pressure (management fee declines, higher costs); (4) regulatory environment; and (5) downward revisions leading to below average 2016 EPS growth,” Mr. Chan said.

“As a result, we are lowering our target multiples across the board to reflect the current market environment. We believe the group should currently trade at a discount to its historical average due to the above mentioned headwinds. In certain cases, we were using premium target multiples.”

Mr. Chan’s changes were as follows:

AGF Management Ltd. (AGF.B-T, sell) to $4.25 from $4.50. Consensus: $5.50. Friday close: $4.14.

Aston Hill Financial Inc. (AHF-T, buy) to 60 cents from 75 cents. Consensus: 62 cents. Friday close: 19 cents.

CI Financial Corp. (CIX-T, buy) to $33.50 from $37. Consensus: $35.68. Friday close: $29.20

Fiera Capital Corp. (FSZ-T, buy) to $14 from $16.50. Consensus: $15.17. Friday close: $10.56.

Guardian Capital Group Ltd. (GCG.A-T, hold) to $18.50 from $19. Consensus: $19.75. Friday close: $16.96.

Gluskin Sheff + Associates Inc. (GS-T, buy) to $22.50 from $26. Consensus: $24.19. Friday close: $17

IGM Financial Inc. (IGM-T, buy) to $39 from $41. Consensus: $42.31. Friday close: $33.36

Sprott Inc. (SII-T, hold) to $2 from $2.20. Consensus: $2.46. Friday close: $1.90

Canadian Stock On Sale – Time To Buy

2015 was “one of the most challenging years in the history of the Canadian equity marketplace,” according to analysts at Canaccord Genuity. The first week of 2016 hasn’t been any better.

That said, it could be a great buying opportunity for investors with “Canada on sale,” analysts at Canaccord say.

“Looking out to 2016, foreign investors (at least the contrarians) could be looking at Canada with a fresh perspective and conclude that most of the headwinds … are discounted in share prices,” the analysts said in a note on Jan. 6.

“Canada could also provide an excellent optionality to a successful soft landing in China, a rebound in oil prices, rising inflation expectations and a de-facto appreciation in the Canadian dollar.”

The analysts have laid out a number of their “best ‘value’ ideas” for 2016, including stocks across various industries that were down at least 20 per cent in 2015 that they believe will rebound in 2016. Below are some of their ideas:

Painted Pony Petroleum Ltd. (PPY-T)

Rating: Buy

Price Target: $15 (Consensus: $8.57, Current: $3.50)

Why buy: “We believe PPY is well positioned going into

2016 due to its compelling valuation, excellent growth profile, and its balance sheet.”

Alaris Royalty Corp. (AD-T)

Rating: Buy

Target: $34 (Consensus: $35, Current: $22.85)

Why buy: “Over the medium term, we favor Alaris for the following reasons; (1) diversified royalty revenue stream; (2) strong capital position to fund large pipeline; (3) attractive dividend yield of 6.9 per cent with potential for dividend growth; (4) operating leverage with relatively fixed cost base; and (5) strong management team with positive track record.”

Valeant Pharmaceuticals Intl (VRX-T, VRX-N)

Rating: Buy

Target: $170 (U.S.) (Consensus $157.57, Current: $98)

Why Buy: “With the establishment of a distribution

partnership with Walgreen’s, we believe that Valeant took its first steps to addressing both the drug pricing and specialty pharmacy issues. The discussion quickly shifted to organic growth at the company’s Investor day in mid-December, and Valeant managed to reset the bar with new financial guidance for 2016. However, a health scare for CEO Mike Pearson has threatened to derail the recovery and sent the stock down 10 per cent on the back of that news; we have no reason to believe that Mr. Pearson will not be back at the helm at some point (and, hopefully, soon).”

Magna International Inc. (MGA-N, MG-N)

Rating: Buy

Target: $66 (U.S.) (Consensus $$59.11, Current $35.70)

Why Buy: “We expect better share price from MGA in 2016 from; 1) sales growth, 2) margin expansion, 3) share buy backs, and 4) possible multiple expansion. We believe MGA should generate good sales growth in 2016 as the company announced that it expected $5 billion of sales growth from 2015-17 in its January 2015 guidance, with most of the growth expected to come in 2016 and 2017 (excluding recent acquisitions, divestitures and FX moves, but we think MGA should have significant sales growth including these factors),” the analysts said. “We also believe MGA could experience significant valuation multiple improvement as the current share price is well below our $71.00 DCF value. The catalyst to better valuation could be improved financial performance.”